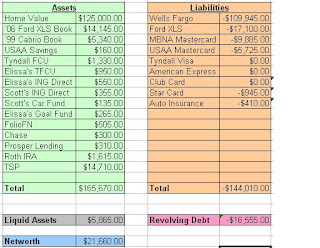

I am back from my long holiday with family with an update. I know that the two or three of you that occasionally wander through my blog have missed my horribly boring financial posts terribly. ;-) Here is the latest picture of my networth:

As you can see, things are going well. Or at least, well enough. Progress is being made. My networth has actually increased by $8770 since my first post here on Blogger. Most of that is from three simple things.

1) Automatic deductions from my paycheck to go into the TSP (retirement) account.

2) Paying all of my bills on time automatically through online bill-pay and other such forms of money handling.

3) Lastly, through Elissa having a job.

That last one is HUGE, btw. With Elissa working, we have made significant inroads towards paying off her car (currently charged to the MBNA Mastercard) as well as saved a lot of money on the other side of the equation in the form of extra savings accounts scattered over the globe. These savings accounts are earmarked for things like....new computers when our current ones no longer work...car repairs...car upgrades...etc, etc. Basically, all of the things that I have been denying myself for the past few years because of my obsessive desire to get out of debt and live frugally to do so.

On the other hand...if Elissa wasn't part of the equation, it's entirely possible that the liabilities side of the equation wouldn't be quite so out of whack...but I'm trying to think positively here. Plus, she can only do so much damage on that side of the equation, which is more than balanced out if she continues to work past the time when we get all of that crap paid off.

So, that being said...this is as good of a point as any to put down a goal for 2007.

My goal for our family for 2007 is to more than double our current networth from $23,725 to approximately $50,000.Think that goal is too ambitious? I don't. And here is how I plan to do it.

Note: all amounts rounded to nearest $25Regular contributions to retirement accounts for 2007 (TSP and Roth) = $4100

Regular bi-weekly payments to mortgage principle + extra payments = $3850

Regular Ford payments to principle, plus extra principle payments = $4000

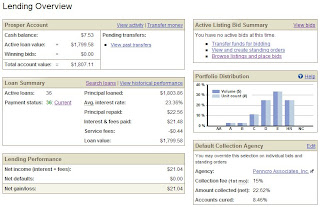

Regular Prosper Loan payments to principle = $550

Regular Contributions to Emergency fund (minus Prosper payments) = $725

Regular Investment in the Stock Market = $1050

Regular Additions to "Car Fund" = $775

Regular payments to principle on USAA Mastercard balance = $1450

For a grand total increase in Networth of (drum roll please......)

=$16500Now, that's just my portion of the puzzle. Elissa is also kicking in $300 per paycheck to help reduce the balance on the MBNA Mastercard, which, when lumped together with my $225 allotment from my paycheck towards that balance equals an

additional $10,500.

So.

If Elissa continues to work, and I continue to put my money where I've been putting it, and Elissa does the same....and if we can somehow avoid the majority of the financial traps that come up in a year, we could theoretically increase our current networth by $27,000, bringing us to a grand total networth of $50,000.

Of course...I'm counting on the stock market to help us offset the depreciation of our vehicles. I'm also assuming that our house will either stay level or increase in price. But, considering that all of the numbers listed above represent just what I currently pay out each month, I don't think that it is unreasonable to think that I could double my networth this year.

The real challenge is going to be trying to double it AGAIN next year! *lol*

I'll keep you posted on how that goes.

~Scott

Labels: budgeting, goals, planning